Understanding the Role of Forex Trading Servers in the Financial Market

The world of forex trading is an exciting yet complex landscape, where millions of traders engage in buying and selling currencies to profit from fluctuations in exchange rates. A critical aspect that can significantly influence a trader’s success is the quality of the infrastructure backing their trading operations. This leads us to one of the key components of this infrastructure—forex trading servers Latin America Trading—which relies heavily on efficient forex trading servers. In this article, we will explore what forex trading servers are, their importance, the factors that affect their performance, and how traders can choose the right servers for their needs.

What are Forex Trading Servers?

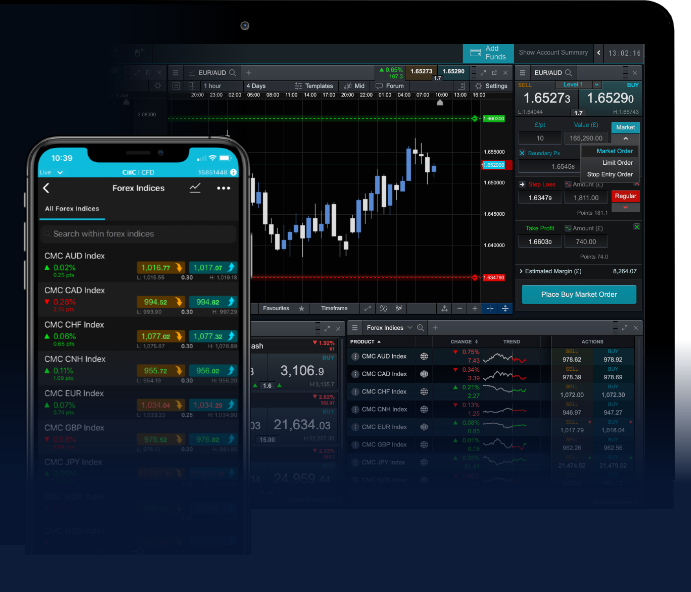

Forex trading servers are high-performance computing systems that facilitate the execution of trades in the foreign exchange market. These servers host the trading platforms and connect traders to liquidity providers, allowing for real-time quote delivery and order execution. The speed and reliability of these servers are crucial, as traders must react quickly to market fluctuations to maximize their profits.

The Importance of High-Quality Forex Trading Servers

1. Speed and Latency: One of the most critical aspects of forex trading is the speed of trade execution. A high-quality trading server minimizes latency, allowing trades to be executed in milliseconds. This efficiency can be the difference between entering or missing a valuable trade opportunity.

2. Uptime and Reliability: The forex market operates 24 hours a day, five days a week. Therefore, the uptime of trading servers is paramount. Any downtime can lead to missed opportunities and potential losses. Reliable servers ensure that traders can access their accounts and execute transactions whenever needed.

3. Data Security: Forex trading involves sensitive financial information. A robust trading server with state-of-the-art security measures protects traders from cyber threats. Secure servers implement features like encryption and firewalls to safeguard data integrity and privacy.

4. Access to Liquidity Providers: Forex trading servers connect traders to a network of liquidity providers, ensuring that they have access to a range of currency pairs and competitive pricing. This connection is critical for effective execution of trades, especially for high-frequency traders.

Factors to Consider When Choosing a Forex Trading Server

1. Location of the Server: The geographical location of the server can significantly affect latency. Traders should look for servers located close to major financial hubs, such as London or New York. Reduced distance results in faster data transmission, leading to quicker trade executions.

2. Type of Server: There are different types of servers, including dedicated, VPS (Virtual Private Server), and cloud-based options. Dedicated servers offer the best performance but come at a higher cost. VPS servers provide a balance between performance and affordability, while cloud-based servers offer flexibility and scalability.

3. Broker Compatibility: Not all forex trading servers are compatible with every broker. Ensure that the server you choose works seamlessly with the trading platform you intend to use. This compatibility can enhance your overall trading experience.

4. Cost: While investing in a high-quality trading server is crucial, it’s essential to evaluate your budget. Analyze the costs associated with different server types and select a plan that matches your trading volume and strategy.

Popular Forex Trading Server Providers

Numerous providers offer forex trading servers with varying features and capabilities. Here are a few well-known names in the industry:

- MetaTrader 4 and 5: These platforms are popular among forex traders and provide in-built server capabilities that enhance trading performance.

- ATC Brokers: Known for their reliable servers and low latency, ATC Brokers offers dedicated server solutions suitable for both retail and institutional traders.

- IC Markets: This broker provides access to a range of liquidity providers, ensuring competitive spreads and fast execution speeds through their advanced server infrastructure.

Conclusion

In conclusion, forex trading servers play a vital role in executing trades efficiently and effectively. By understanding their importance and the factors affecting their performance, traders can make informed decisions when selecting a server that best meets their needs. High-quality servers contribute to reducing latency, enhancing security, and providing access to liquidity, ultimately leading to a more successful trading experience. As the forex market continues to evolve, staying updated on the latest technological developments in server infrastructure will be beneficial for both new and experienced traders alike.

لا تعليق